Stock Trading Platforms and Brokers

Stock Trading Platforms and Brokers

Jude Ohanele

9/15/20233 min read

Stock Trading Platforms and Brokers

Stock trading platforms and brokers play a crucial role in facilitating the buying and selling of stocks and other financial assets. These platforms and brokerage firms vary widely in terms of features, services, and accessibility, catering to the diverse needs of traders and investors around the world. Let us take a look at stock trading platforms and brokers.

1. Stock Trading Platforms

Online Trading Platforms: These are web-based platforms that allow traders to buy and sell stocks through their internet browsers. They often provide real-time market data, research tools, and order execution capabilities.

Desktop Trading Software: Some advanced traders prefer downloadable desktop applications that offer enhanced features, customization, and faster execution speeds.

Mobile Trading Apps: Mobile apps are designed for trading on smartphones and tablets, providing convenience and accessibility to traders on the go.

2. Features of Trading Platforms

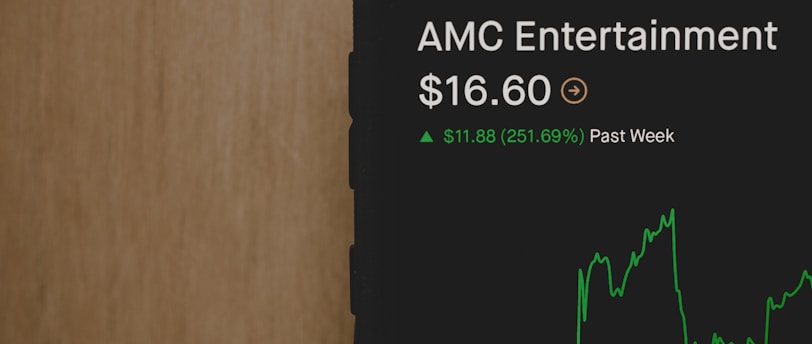

Market Data: Reliable access to real-time and historical market data is crucial for informed decision-making.

Research Tools: Many platforms offer research reports, analysis, and charting tools to assist traders in making investment choices.

Order Types: Different order types like market orders, limit orders, stop orders, and trailing stops allow for precise control of trades.

Risk Management: Risk management features such as stop-loss orders and take-profit orders help traders limit potential losses.

Customization: Traders can often customize their trading platforms to suit their preferences, including layout, watch lists, and alerts.

Paper Trading: Practice accounts or demo modes allow users to trade with virtual money to gain experience without risking real capital.

3. Stock Brokers

Full-Service Brokers: These brokers offer a wide range of services, including research, investment advice, portfolio management, and trading assistance. They are suitable for investors seeking personalized guidance.

Discount Brokers: These brokers provide a more streamlined service, typically with lower fees and commissions. They are ideal for self-directed traders who prefer to make their own investment decisions.

Online Brokers: Most brokers offer online trading services, making it easy for individuals to trade stocks and other assets through their platforms.

Robo-Advisors: Some brokers offer robo-advisory services, which provide automated portfolio management based on clients' risk profiles and goals.

4. Regulation and Security

Stock trading platforms and brokers are subject to regulation by financial authorities in their respective countries to ensure investor protection and market integrity. You are advised to choose only regulated brokers to mitigate the risk of fraud or malpractice.

5. Global Presence

Some stock trading platforms and brokers operate globally, providing access to a wide range of international markets and assets. Some brokers offer multi-currency accounts for trading in various currencies.

6. Fees and Commissions

Fees and commissions can vary significantly among brokers. It is essential for you to understand the cost structure and choose a broker that aligns with your budget and trading frequency.

7. Customer Support

Always consider that responsive customer support is crucial, especially for resolving technical issues, account inquiries, and trading-related questions.

8. Educational Resources

Some brokers offer educational resources, webinars, and tutorials to help traders improve their skills and understanding of the market.

9. Trading Accessibility

Accessibility to various financial markets, including stocks, bonds, options, commodities, and cryptocurrencies, varies among brokers. You should choose a platform that aligns with your asset preferences.

10. Execution Speed and Reliability

High-frequency traders may prioritize brokers and platforms known for fast and reliable order execution.

11. Account Types

Brokers may offer different types of accounts, including individual, joint, retirement, and corporate accounts, to cater to various client needs.

12. Margin Trading

Some brokers offer margin trading, allowing traders to borrow funds to leverage their positions. This can amplify both gains and losses and requires careful risk management.

Stock trading platforms and brokers serve as vital intermediaries for investors and traders to access financial markets. The choice of a platform or broker should be based on individual preferences, trading goals, risk tolerance, and the specific features and services offered. Conducting thorough research and due diligence is essential to select the most suitable platform or broker for your needs. Best wishes as you trade.